☰ Navigate this post:

Published October 25, 2018

Research aims

In class discussions, we linked age to lifetime financial landmarks such as legal partnerships, dependents, home renting and ownership, our careers and earnings, and planning for retirement. We aimed to discover:

- What services or tasks are most accessed by banking app users.

- Whether this linked to the landmarks.

- How to exploit results to improve a flow.

Planning research

Caveat our project team’s limited research resources, we employed limited methodologies. Our strategies include:

- Online questionnaires to gather attitudes and insights into behaviours.

- Usability testing the existing Ulster Bank app.

- Competitor analysis

- Review of Fintec persona practice

Research Resources

Our heuristic evaluations of the Ulster Bank app proved similar.

Usability tests were limited by candidates and resources. We aimed to identify a 100% UX, requiring larger samples than Neilson’s (2000), “five candidates give 85% results” suggests. The Ulster Bank may have adhered to this rule and missed that 15% of a delightful UX? We need better.

My study partner, Goran Peuc introduced me to the Google Forms platform proving superior to my Typeform habit. We distributed our questionnaires through social media.

Ethics

Ethical considerations include freedom to decline, data privacy, inclusiveness, and anonymity and which questions Require answered. I made Gender optional. No “personal data” defined by the Data Protection Commission (2018) was collected.

Questions were designed with quick reference to the work of Cohen, Manion, and Morrison (2003, pp. 245-266).

Questionnaire Results

Results are available at Appendix A. Of the banking app users I sampled (Figure 1):

| Area | Result |

|---|---|

| Age |

|

| Access |

|

| Accounts | 79% have more than one account on their banking app. |

| Dependants | 48% of households include dependents with their own bank accounts. |

| Privacy | 59% prefer to use their banking app where no one else can see. |

| Scenarios | Only 3% of respondents use their banking app to pay in cheques, make deposits, or to check progress on their mortgage. (Caveat, not all Irish or UK banking apps have these features). |

| Timeouts | 72% have experienced a “session timed-out” message during their completing a task. |

| Experience | 85% expressed their overall experience as four or five stars out of five. |

Goran’s questionnaire results were comparable.

We conclude that

- our users value their privacy when banking,

- a majority have experienced session time-outs,

- priority and frequent tasks are Pay tasks,

- despite obvious flaws in banking apps, the experience is graded high. Irritations and frustrations aside apps get the job done.

User testing

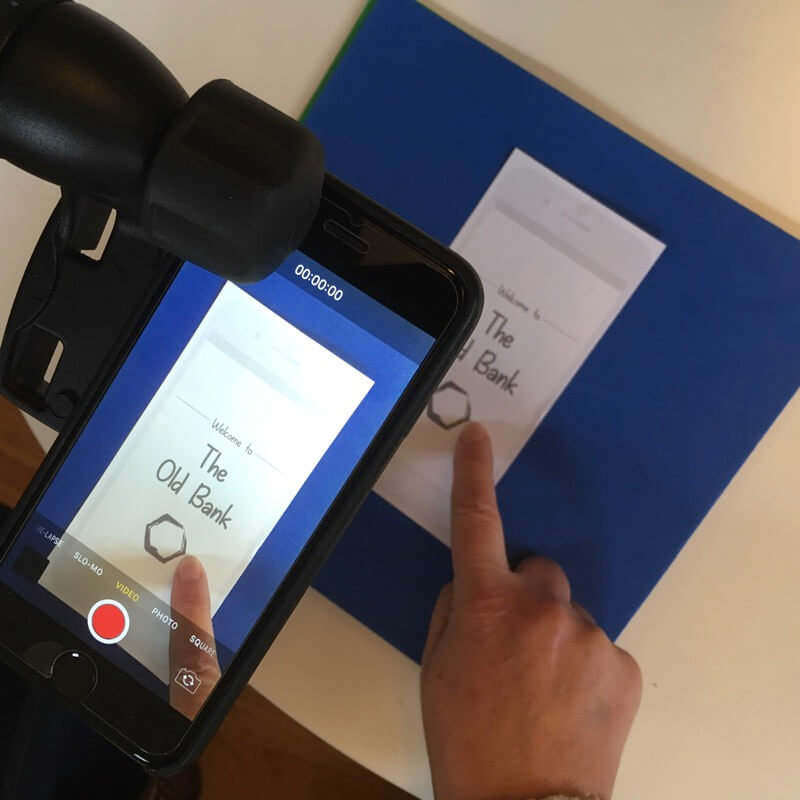

We each videoed a user test (Figure 2).

Tests used a paper-styled app version produced by Goran to reduce discrimination between our future paper prototype and the live app: the “feel” between paper and ‘UI’. This video demonstrates it:

Candidates were reluctant to be recorded for fear of making “mistakes”. The small sample proved useful. Among insights observable in the following two user test videos were:

- Confusion on which was the homepage.

- Cognitive stress when choosing which Pay task to choose from six.

- Adding a new payee jarred the experience.

- The pay task may benefit a Save or Favourites accelerator feature.

Competitor analysis

The Ulster Bank app’s use of Touch ID is a UX advantage over Bank of Ireland’s business banking app.

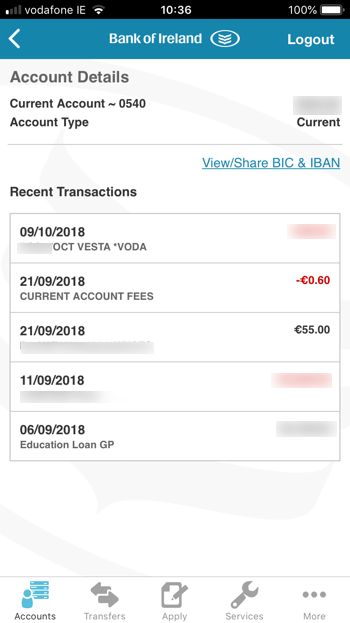

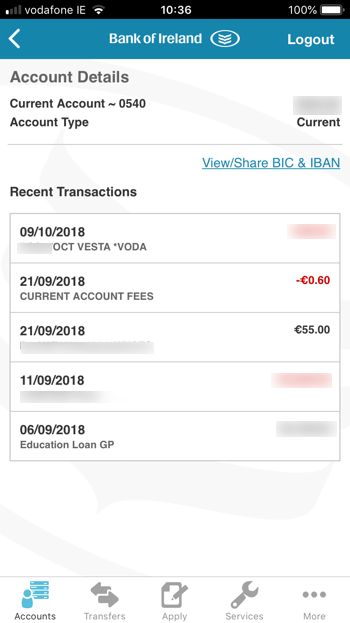

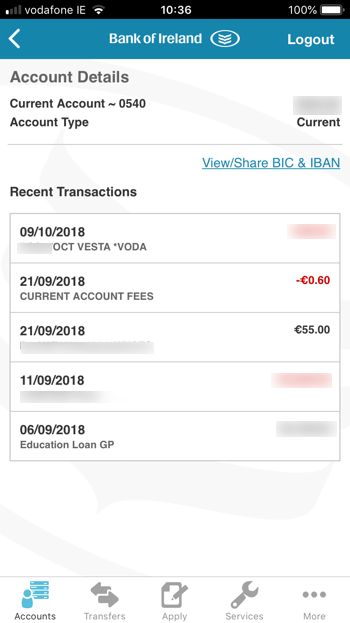

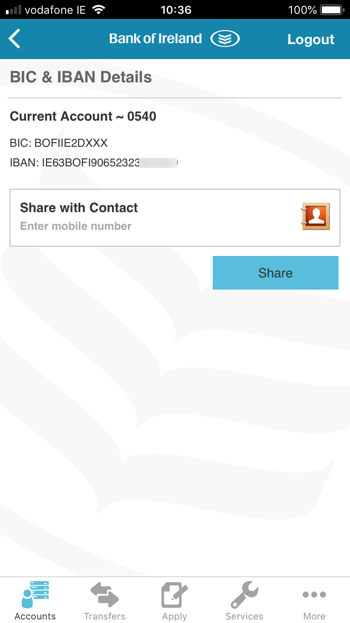

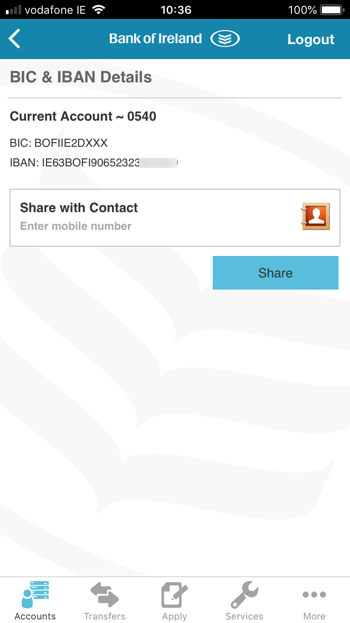

The Bank of Ireland app bundles payments, transfers, and Pay To Mobile as Transfers in the main navigation. Logout, an ill-advised term (Microsoft, 2012, p. 329), is permanently located in the top-right unless the in-app browser is open (Figures 3 to 6).

Settings and regulatory information are accessed using the Menu button in the permanent navigation bar. Although not an obvious pathway, it is an easy one to understand and to use.

Overall, the app appears simpler than the Ulster Bank app — if less “modern”. It may be easier to use? There are fewer inconsistencies in the UI and flows.

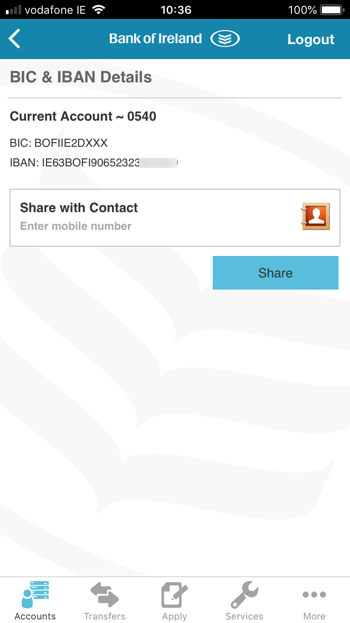

The ability to copy or share the account BIC and IBAN (Figure 6) is an advantage the Ulster Bank fails to facilitate.

In summary, the Bank of Ireland app demonstrates how settings and management tasks may locate together.

Personas and scenarios

Personas, fictitious descriptions typifying groups of users (University of St Andrews, 2018) and scenarios inform design thinking. They provide insights and answer, “so what?” (Preece, Rogers, Sharp, 2015) and enable meeting a wide audience’s needs without prejudicing secondary users (Cooper, Reimann, Cronin, Noessel, 2014).

Persona research

Personas are a compromise of time vs. resource where requirements depend on our enterprise needs. They may result from a paucity or an abuse of research and analysis skill and resources. For example, Lean personas (Cao, 2016), which our low-resource project persona process closely resembles.

I blogged my online user research, Assuming Fintec personas (for a low-resource project) (Godfrey, 2018) to compensate our low project resources. I summarise that:

- Personas are collated for and differ between marketing and service delivery needs.

- Known knowns about human behaviour may be taken for granted as knowns, which risks their compromise when unknown.

- Too concise persona posters may proliferate borrowed beliefs that do not relate to our product or its users.

I crafted two poster personas and question the approach. I surmise persona content, depth, and detail depends on the role and use of the personas. Posters may benefit being HTML documents, where:

- Printed posters are valid only at the moment of printing.

- Selected information is printable.

- Rapid updating and distribution of changes during the persona lifecycles are made possible.

- Links to, or progressive reveal strategies enable depth of information and instruction where and when needed including unknown unknowns, multi-media, and links to parent research?

Persona attributes

Our research, user stories, and assumptions identify our users’ and our enterprise’s aims and objectives and feed the personas’ attributes.

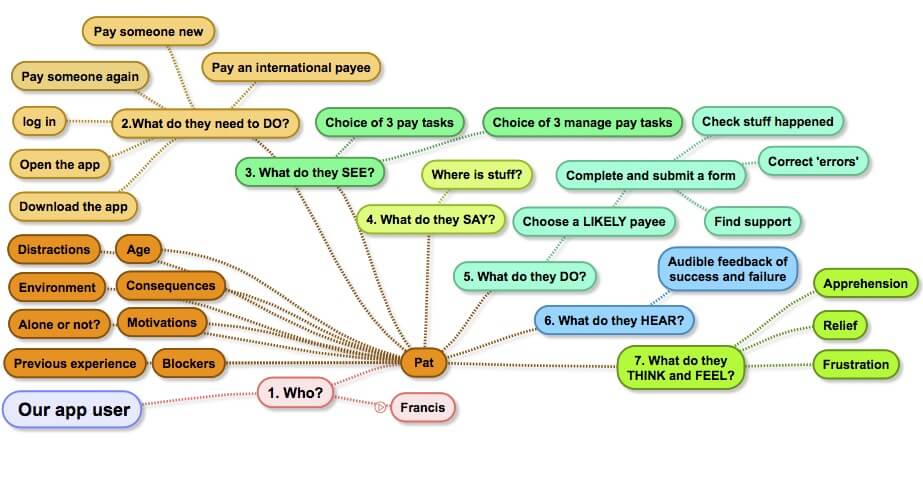

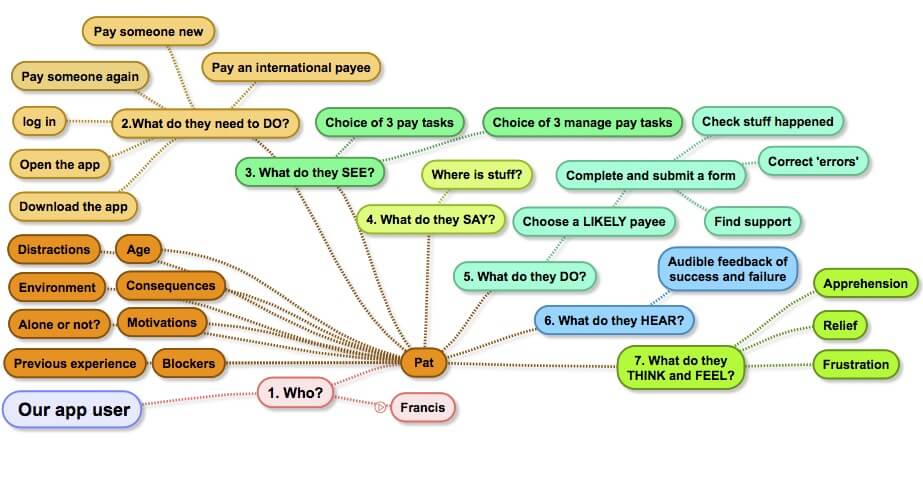

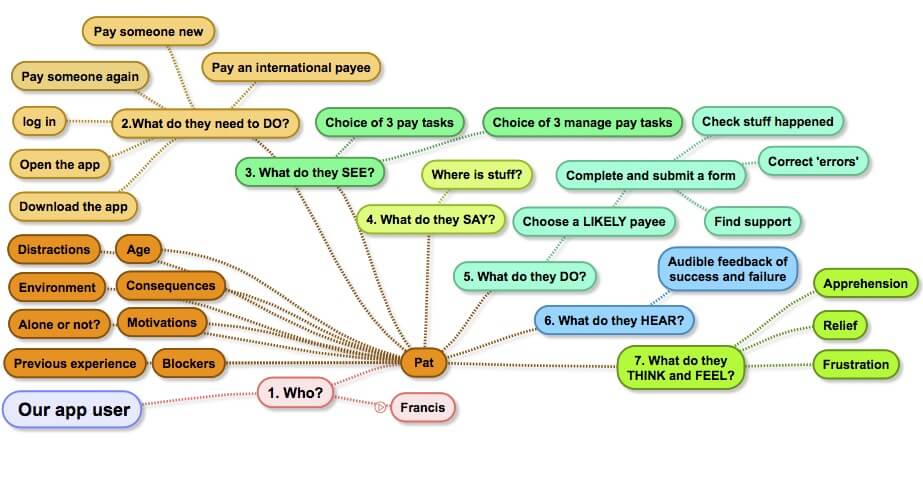

Johari Window (Luft and Ingram 1955 as cited in Wikipedia 2018) styled empathy maps collate and bring sensory, personality, and situational attributes “to life” (Gray 2017). A mind-map scaffolds a similar model (Figure 7, and Appendix B (PDF 210 KB)). Although useful, insufficient research failed to flesh it out.

With the paucity of research, I took an overview of our banking app using my Basic User Journey tool (Figures 8 and 9). It scales from the universal experience to discrete interaction design.

| Journey Stage | Concept |

|---|---|

| Wants |

Our user wants:

Our enterprise wants:

|

| Needs |

Our user needs to:

Our enterprise needs to:

|

| Tasks |

Our user will:

Our enterprise will:

|

| Input |

Our users will input:

|

| Output |

Our enterprise will output:

|

| Review |

Our user will:

Our enterprise will:

|

| Recycle |

Our user will:

Our enterprise will:

|

Persona stories

50% of my questionnaire respondents are male or female. Gender is likely irrelevant anyway without evidence of differences in approach or ability? The persona names therefore aim to be inclusive of genders. Francis’ portrait a transgender radio personality (SurreyLive, 2018). Gender discrimination is invited and then challenged!

Persona portraits are often prescribed like passport photos. Without personality, how can our personas become “real”? Pat is smiling and enjoying a social activity. Really. Why should we make her miserable?

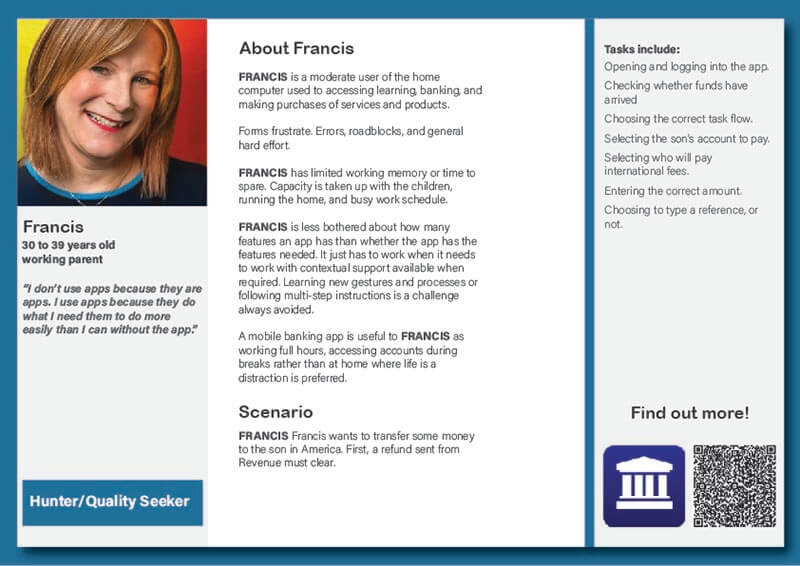

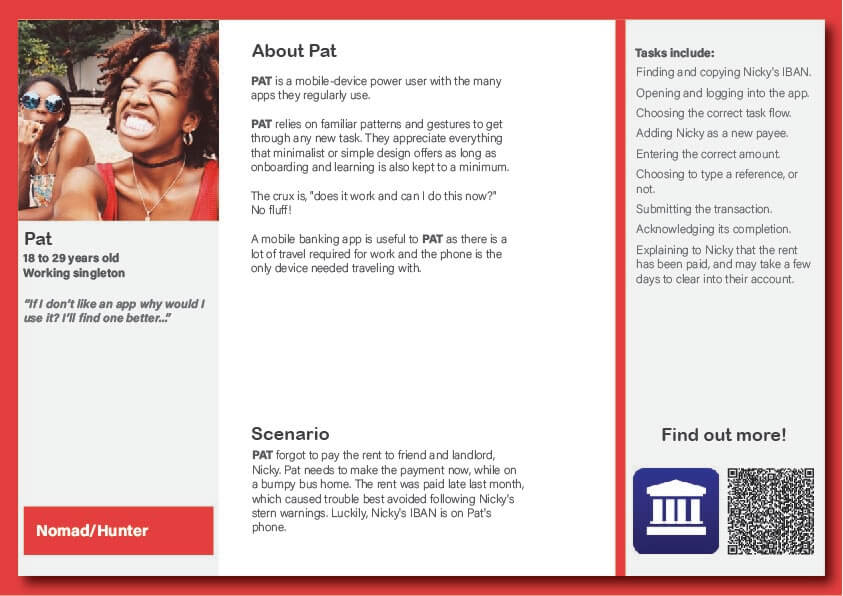

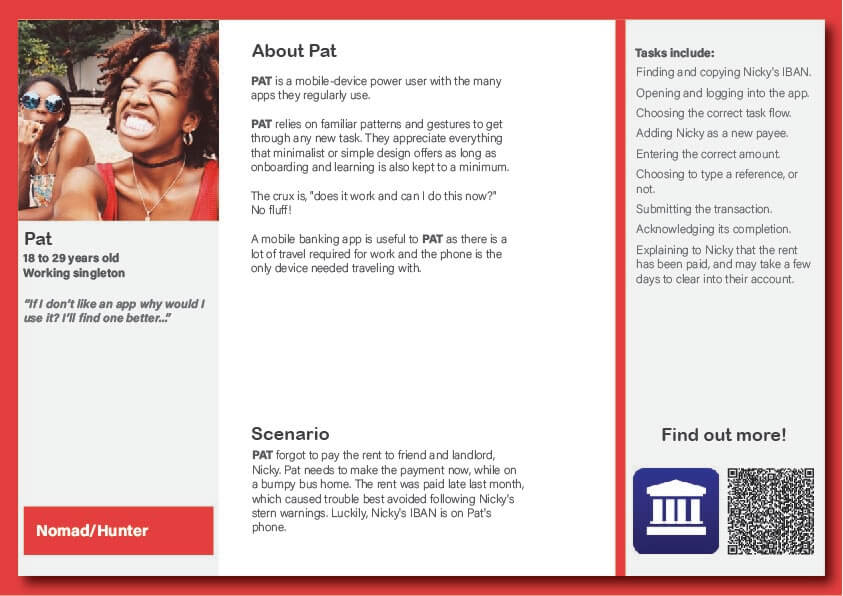

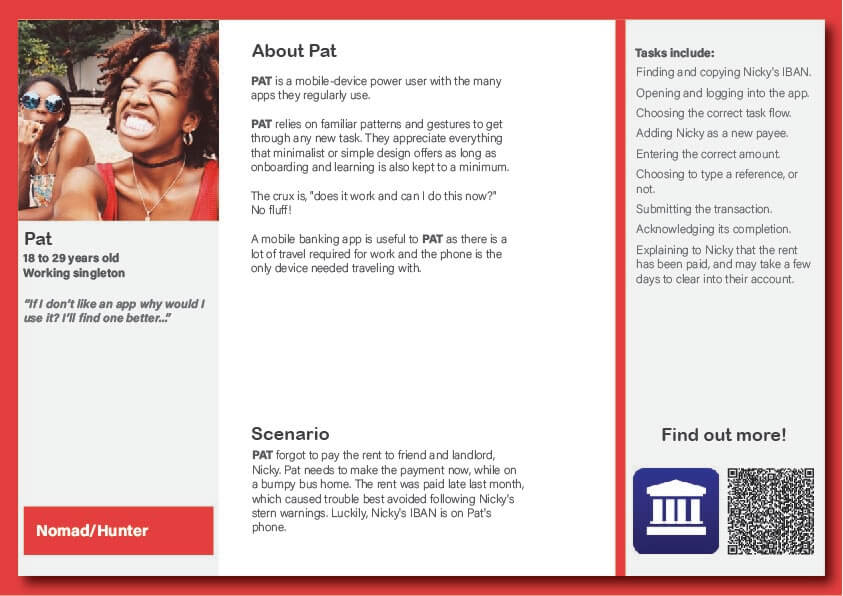

Borrowed beliefs that age describes digital ability or behaviour are irrelevant. Our users evolve. Age indicates life landmarks in our research. Francis and Pat (Figures 10 and 11) model two age-related and non-specific landmarks and include Accenture’s (2017) behavioural groupings found in my Fintech persona research. More thorough research should improve accuracy (Cooper et al, 2014, p.59).

FRANCIS (40 to 49 years old, Hunter/Quality Seeker (Accenture, 2017)) is a moderate user of the home computer used to accessing learning, banking, and making purchases of services and products.

Forms frustrate. Errors, roadblocks, and general hard effort. FRANCIS has limited working memory or time to spare. Capacity is taken up with the children, running the home, and busy work schedule.

FRANCIS is less bothered about how many features an app has than whether the app has the features needed. It just has to work when it needs to work with contextual support available when required. Learning new gestures and processes or following multi-step instructions is a challenge always avoided.

A mobile banking app is useful to FRANCIS as working full hours, accessing accounts during breaks rather than at home where life is a distraction is preferred.

(Image sourced from SurreyLive (2018))

PAT (18 to 29 years old, Nomad/Hunter (Accenture, 2017)) is a mobile-device power user with the many apps they regularly use.

The crux is, “does it work and can I do this now?” No fluff!

A mobile banking app is useful to PAT as there is a lot of travel required for work and the phone is the only device needed travelling with.

(Image sourced from Twenty.com (2018).

Two scenarios

Scenarios are stories. They may be elaborate or simple depending on what a design needs informing (Preece, Rogers, Sharp, 2015). For this project, our focus is on the Pay task areas our personas are likely to engage with.

Scenario 1.

Francis wants to transfer some money to the son in America. Tasks include:

- Opening and logging into the app.

- Choosing the correct task flow.

- Selecting the son’s account to pay.

- Selecting who will pay international fees.

- Entering the correct amount.

- Choosing to type a reference, or not.

- Submitting the transaction.

- Acknowledging its completion.

- Telling the son that the transaction has been ordered.

Scenario 2.

Pat forgot to pay the rent to friend and landlord, Nicky. Pat needs to make the payment now, while on the bumpy bus home. The rent was paid late last month, which caused trouble best avoided following Nicky’s stern warnings. Luckily, Nicky’s IBAN is on Pat’s phone. Tasks include:

- Finding and copying Nicky’s IBAN.

- Opening and logging into the app.

- Choosing the correct task flow.

- Adding Nicky as a new payee.

- Entering the correct amount.

- Choosing to type a reference, or not.

- Submitting the transaction.

- Acknowledging its completion.

- Preparing to explain to Nicky that the rent has been paid, and may take a few days to clear into their account.

Two personas

Open these personas as a PDF (2 MB) from Appendix C. The QR represents the potential to link to an HTML document, supporting media, etc. (Figures 13 and 14).

References

Accenture. (2017). 2017 GLOBAL DISTRIBUTION & MARKETING CONSUMER STUDY. Retrieved September, 2018 from https://www.accenture.com/us-en/insight-financial-services-distribution-marketing-consumer-study

Cao, J. (2018, June 15). The UX Designer’s 5-Minute Guide to Lean Personas. UX Pin. Retrieved October 8, 2018, from https://www.uxpin.com/studio/blog/ux-designers-5-minute-guide-lean-personas/

Cohen, L., Manion, L., and Morrison, K. (2000). Research Methods in Education (5th Edition) (pp. 246-266). New York, NY: RoutledgeFalmer.

Cooper, A., Reimann, R., Cronin, C., and Noessel, C. (2014). About Face, The essentials of interaction design. Indianapolis, IN, USA: John Wiley & Sons.

Data Protection Commission, (2018). What is Personal Data? Dataprotection.ie. Retrieved October 18, 2018, from https://www.dataprotection.ie/docs/What-is-Personal-Data/210.htm

Godfrey, P. (2017). A UX design process with ADDIE. (2017, July). Retrieved October 8, 2018 from https://www.learningtoo.eu/portfolio/ux-design-process-with-addie.htm

Gray, D. (2017, July 14). Empathy Map. Gamestorming. Retrieved October 10, 2018 from https://gamestorming.com/empathy-mapping/

Microsoft, (2012). Microsoft Manual of Style (4th Edition). Redmond, WA, USA: Microsoft Press.

Nielson, N. (2000, March 19). Why You Only Need to Test with 5 Users. Nielson Norman Group. Retrieved October 10, 2018 from https://www.nngroup.com/articles/why-you-only-need-to-test-with-5-users/

SurreyLive, (2018). Transgender woman from Woking becomes ‘voice of Channel Four’ as guest announcer. Retrieved September 29, 2018 from https://www.getsurrey.co.uk/news/surrey-news/transgender-woman-woking-becomes-voice-11120579

University of St Andrews, (2018). Digital standards, User personas. Retrieved October 8, 2018 from https://www.st-andrews.ac.uk/digital-standards/service-manual/user-personas/

Wikipedia, (2018, October 15). Johari Window. Wikipedia, The free encyclopedia. Retrieved October 18, 208, from https://en.wikipedia.org/wiki/Johari_window

Images

Elise, Copyright Twenty.com (2018). Retrieved September 29, 2018 from https://www.colorlines.com/articles/black-women-were-not-superheroes-were-human.

SurreyLive, (2018). Transgender woman from Woking becomes ‘voice of Channel Four’ as guest announcer. Retrieved September 29, 2018 from https://www.getsurrey.co.uk/news/surrey-news/transgender-woman-woking-becomes-voice-11120579

Navigate this post

- Research aims

- Planning research

- Questionnaire results

- User testing

- Competitor analysis

- Personas and scenarios

- Two scenarios

- Two personas

- References

- Appendix A. Questionnaire.

- Appendix B. Empathy mind map (PDF 210 KB).

- Appendix C. Building the personas

Word count: less figures, captions, and navigation, 1080